Financial Independence, Retire Early (FIRE). When you first hear “FIRE”, unless you are already familiar with the movement, your mind probably thinks of flames, heat, and potential danger. This is not the FIRE I’m talking about.

FIRE stands for Financial Independence, Retire Early. It’s a movement of people dedicated to extreme levels of saving and minimal spending. This is all in an attempt to achieve financial independence and retire early (hence the name).

People who follow this movement passionately go all out to find the maximum cost savings possible. I’ve heard stories of people eating rice and beans instead of pricier vegetables or proteins. Living out of their cars or downsizing and renting a room in a shared house.

Many of these stories include people in high-paying corporate jobs. They are making a significant amount of money, thus enabling them to save more. This higher income coupled with extreme savings can lead to massive increases in wealth year over year. It’s doable but it can affect your sanity.

This is not our situation.

FI: Financial Independence

Our approach to achieving our financial goals is more relaxed but still aggressive. We follow the FI movement: Financial Independence. The aim is to get to a point where we don’t need to work traditional jobs anymore. Where we won’t worry about where a paycheque is coming from.

How will we achieve this? Generating passive income is key. Passive income is income earned with minimal time or effort. For the sake of this post, it is the interest and/or dividends paid to you on your current savings or investments.

To pay for expenses, we plan to draw down 3-4% per year from our investment accounts. “To draw down” means to pull money from an account. For example, if you have a retirement account of $1,000,000, you would pull $30,000 to $40,000 from it per year. This is the 3-4% rule.

This gives us the freedom to do what we want. We will still work, try new things, and earn supplemental income. But these wouldn’t be a necessity for our survival. We will travel the world and continue to work because we want to. Not because we have to. That’s what retire early means to us.

Check out how we currently afford to travel here: How To Budget: The Ultimate Guide to Save for Travel

But What Does It All Mean?

Between Luke and myself, I am not the expert. I will explain our goals from my perspective for those of you who, like me, are not well-versed in the minute details of the ups and downs of markets and investments. In this and future posts, I will provide explanations and examples of how we push towards achieving FI. I will try to break it down into easier-to-understand concepts. Luke will add supplemental details throughout.

Neither of us are financial experts nor do we have financial backgrounds. This and related posts are what works for us. We’ve done our homework. Well, Luke has done his homework. I reap the benefits of his research. We’ve determined what works for us through trial and error.

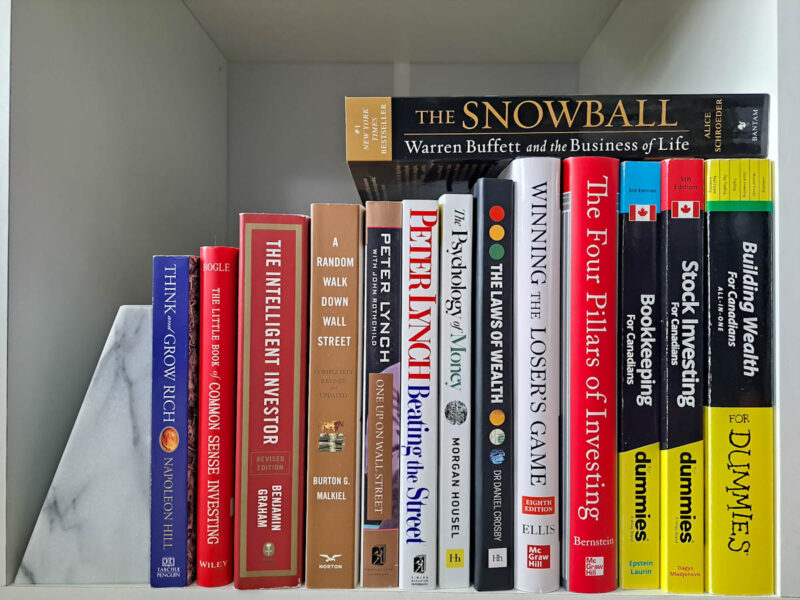

In no way will we provide financial advice. Nor will we tell you the specifics of what investments to buy. If you are interested in pursuing FIRE or other financial goals, there are resources available online and in person. We are happy to share some of the resources that help guide our financial independence, retire early journey.

In further posts, we will provide details of how we budget and save. This will include things like groceries and monthly bills. Our savings and spending allocations. And all our fun budget-saving tips.

The information provided below is a very basic, simplistic understanding of FIRE and FI. Many factors affect everyone differently and at different times. As with everything, please do your research.

Without further ado, let’s dive into what FIRE is.

When the FIRE Starts to Burn

The FIRE movement started in the early 1990’s. The term was defined in the book, Your Money or Your Life by authors Vicki Robin and Joe Dominguez. Their book emphasizes the importance of evaluating your spending against how many hours working it took to get it. You then compare that to the value you received.

That book was foundational, but the 80’s and 90’s was a very different world to the one we are in now. We currently live in a low-interest-rate world. This world requires you to take more risks to be rewarded.

The movement had a resurgence in the early 2010’s among select millennials. This was mostly due to uncertain and volatile financial markets (I’m looking at you 2008). Now people want to take back control of their financial future.

There are a couple of key defining aspects of the FIRE movement:

- Extreme levels of cost-savings

- Aggressive saving

- Investing

It’s not about becoming insanely wealthy. The goal is to reach a point that is enough for you. Where you can quit the traditional 40-hour work week. And live life on your terms.

What is Retirement?

Retirement as we know it dates back to around 1900. The German Chancellor at the time, Otto von Bismarck, decided it was high time to pay anyone over the age of 70 to leave their jobs. This opened employment opportunities for the younger, unemployed workforce.

Let that sink in for a minute. Why are we still following the same rules as 100 years ago?

We think differently around here. We challenge the status quo.

Before We Dive Deeper

A little disclaimer before we dive deeper as our situation may differ from yours. We do not have kids. Both of us are employed full-time. One would describe us as middle class. And we have a small mortgage.

While I genuinely feel that almost anyone with drive and determination can reach Financial Independence before the normalized retirement age, there are obstacles in the way.

Having high-interest debt will hamper you in your pursuit. Not having an emergency fund that covers at least 6 months of living expenses can and will give you a headache. If something goes wrong, you need to be able to pay for an emergency. It’s important to cover these bases first.

Pursuing FIRE isn’t a race and it isn’t for everyone. It’s a lifestyle that we have chosen to adopt that prioritizes the things we love in life. It forces us to question many things in the modern world. Our early escapades in Southeast Asia circa 2013 shaped this lifestyle choice more than we realized.

Traveling doesn’t have to deter your financial goals. Check out Part 1 of our 3-Part Budget Travel Tips series here to learn more: Budget Travel Tips: The In-Depth Simple Guide (Part 1)

Your FIRE Number

Do you want to retire early? Great, us too. But how much money do you need?

How much money you need is your FIRE number. The dollar amount you need to save before you can walk away. It’s an estimate of how much money you need to retire.

A very rudimentary equation to determine your FIRE number is as follows:

- Take your current yearly expenses and multiply them by 25.

- For example, if you’re spending $40,000 per year you would multiply that by 25 to get $1,000,000.

- Yearly Expenses: $40,000

- Multiply by 25

- FIRE number = $1,000,000

- For example, if you’re spending $40,000 per year you would multiply that by 25 to get $1,000,000.

According to this calculation, you need $1,000,000 saved in the bank and/or investments to retire comfortably.

Yes, that is an enormous number. However, it’s not as big as you think. You won’t need to save a million dollars. Compound interest will do most of the leg work for you. But, you will have to save a decent amount.

The theory is simple: the more you save and invest, the faster you will reach Financial Independence. As we said earlier, we’re aggressive, but not to a point where we’re not living our life in the here and now.

What is Compound Interest?

Compound interest is when your money makes money over time. Think free money. Making your money work for you.

“But, Erin and Luke, nothing is free in the world”. You may be thinking. Oh, how somewhat right and wrong at the same time you are, dear reader.

Example: Compound Interest

Let’s say you have 10 years. And you start with $10,000 in an investment account. Your investment account consists of low-cost Index Funds generating a market average of around 7%. (Historically the market average has been around 10% per year minus 2%-3% inflation reduction over the last century).

Over 10 years, your money could grow as outlined in the table below:

| Year | Year Start | Yearly Interest | Total Interest | Total Value |

| 1 | $10,000 | $718.59 | $718.59 | $10718.59 |

| 2 | $10718.59 | $770.23 | $1488.82 | $11488.82 |

| 3 | $11488.82 | $825.57 | $2314.39 | $12314.39 |

| 4 | $12314.39 | $884.90 | $3199.29 | $13199.29 |

| 5 | $13199.29 | $948.49 | $4147.78 | $14147.78 |

| 6 | $14147.78 | $1016.65 | $5164.43 | $15164.43 |

| 7 | $15164.43 | $1089.70 | $6254.13 | $16254.13 |

| 8 | $16254.13 | $1168.00 | $7422.13 | $17422.13 |

| 9 | $17422.13 | $1251.94 | $8674.07 | $18674.07 |

| 10 | $18674.07 | $1341.90 | $10015.97 | $20015.97 |

With an initial investment of $10,000 and no other additions, over 10 years, $10,000 may turn into $20,015.97. This means you make $10,015.97 for doing absolutely nothing. Ladies, gentlemen, and all people, this is compound interest.

If you apply the same logic over 40 years, $10,000 becomes $160,511.76. It is as good as magic.

Words of Wisdom

Albert Einstein said it best himself “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

All situations are different. You might need more or less money. It may take more years or fewer years. There is no one-size-fits-all here.

Whatever you do will help you on your way to retirement. Hopefully, that means retire early.

How Much Do You Need?

Run your numbers here with the Playing with Fire calculator. It’s easy to use and visualize but does require you to know your information, including your net worth.

For transparency, we invest solely in low-cost Index Funds across all our accounts and manage our own investments.

As we mentioned before, this lifestyle won’t be for everyone. However, one big takeaway is that it’s never too early or too late to start saving. Some versions of “Financial Independence, Retire Early” can be achievable.